What LPs Really Want: Value Creation as a Differentiator in PE Firm Selection

Why Operational Value Creation is the new battleground for LP confidence—and how GPs can respond.

In today’s private equity landscape, past performance is no longer enough. According to new survey findings from GP-Score, institutional investors across North America and Europe, are placing more weight on a PE firm’s ability to drive Operational Value Creation (OVC). In fact, many now see it as a dealbreaker in manager selection.

One LP quoted in the survey report, stated, “Five years back we would never ask questions about value creation methods. Now it can become a deal breaker.”

As the pressure builds for GPs to prove not just their historical returns but their repeatability, the question becomes: how can PE firms demonstrate differentiated, disciplined, and transparent value creation capabilities that resonate with LPs?

The Rise of Operational Value Creation as a Selection Criterion

Across the board, survey respondents signaled a clear shift in how they evaluate managers. OVC capabilities now sit near the top of the checklist—outweighing fees, and in some cases, even overshadowing traditional performance metrics.

Why? Because in a market environment characterized by higher acquisition multiples, operational complexity, and tighter returns, LPs recognize that sustainable alpha depends on what happens after the deal is closed. Firms that can’t clearly articulate their value creation strategy – or worse, rely on anecdotal success – are at risk of falling behind.

Despite its rising importance, many LPs still struggle to evaluate OVC effectively, with internal resources, lack of visibility, and generic storytelling from managers remaining as key barriers.

GP-score, LP Survey 2025

The Credibility Gap: What LPs Want to See

While pitch decks may have sufficed in the past, they no longer hold water with today’s increasingly sophisticated LPs. The survey from GP-score found, and this is consistent with our client discussions, that the most convincing evidence of value creation strength included:

- Details of frameworks and how they’re applied

- Case studies with measurable outcomes

- Granular, asset-level data

- Specific timelines and engagement models

- Lessons learned and course corrections.

A generic “we have operating partners” statement won’t cut it anymore. LPs want substance. This is where platforms like Maestro come in—enabling GPs to standardize, scale, and showcase value creation approach with precision. By equipping firms with a centralized, digital Value Creation Management Platform (VCMP), Maestro helps GPs build the kind of institutionalized discipline and transparency that LPs are increasingly demanding.

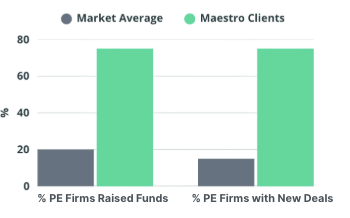

A 4X Fundraising Advantage

Our client base, and its success, is further proof that investors back firms with proven systems. In the last two years, Maestro users outperformed the market for fundraising, deals closed, and portfolio growth.

In 2023 and 2024, Maestro clients raised capital at a 75% rate – compared to the 20% industry average.

That’s almost a 4x fundraising advantage in a tough environment. This isn’t luck. It’s structure, systems, and execution—powered by Maestro.

And as for deals and portfolio growth? It’s a similar story among our client base… on average, our clients have expanded their portfolio size in Maestro by 2-4x over the last 2 years.

A New Era of Accountability—and Opportunity

The message from LPs is becoming clear: they increasingly expect clarity of process, consistency of execution and credible evidence of outcomes.

They expect insight into what’s happening behind the curtain. Which raises both a challenge and an opportunity for GPs: providing consistent visibility into the execution of value creation plans, without overburdening internal or LP teams. Platforms like Maestro are designed precisely for this purpose, giving LPs peace of mind without the endless back-and-forth reporting.

As the gaps widen between firms with scalable, measurable OVC strategies and those with ad hoc approaches, the winners will be those who can provide clarity and confidence across the value creation lifecycle.

For GPs, that means moving toward a systemized approach. For LPs, it means asking better questions and, importantly, expecting better answers. And for the industry, it marks a shift toward more durable, data-driven value creation.

Want to learn how Maestro helps top-performing GPs demonstrate value creation discipline? Get in touch.