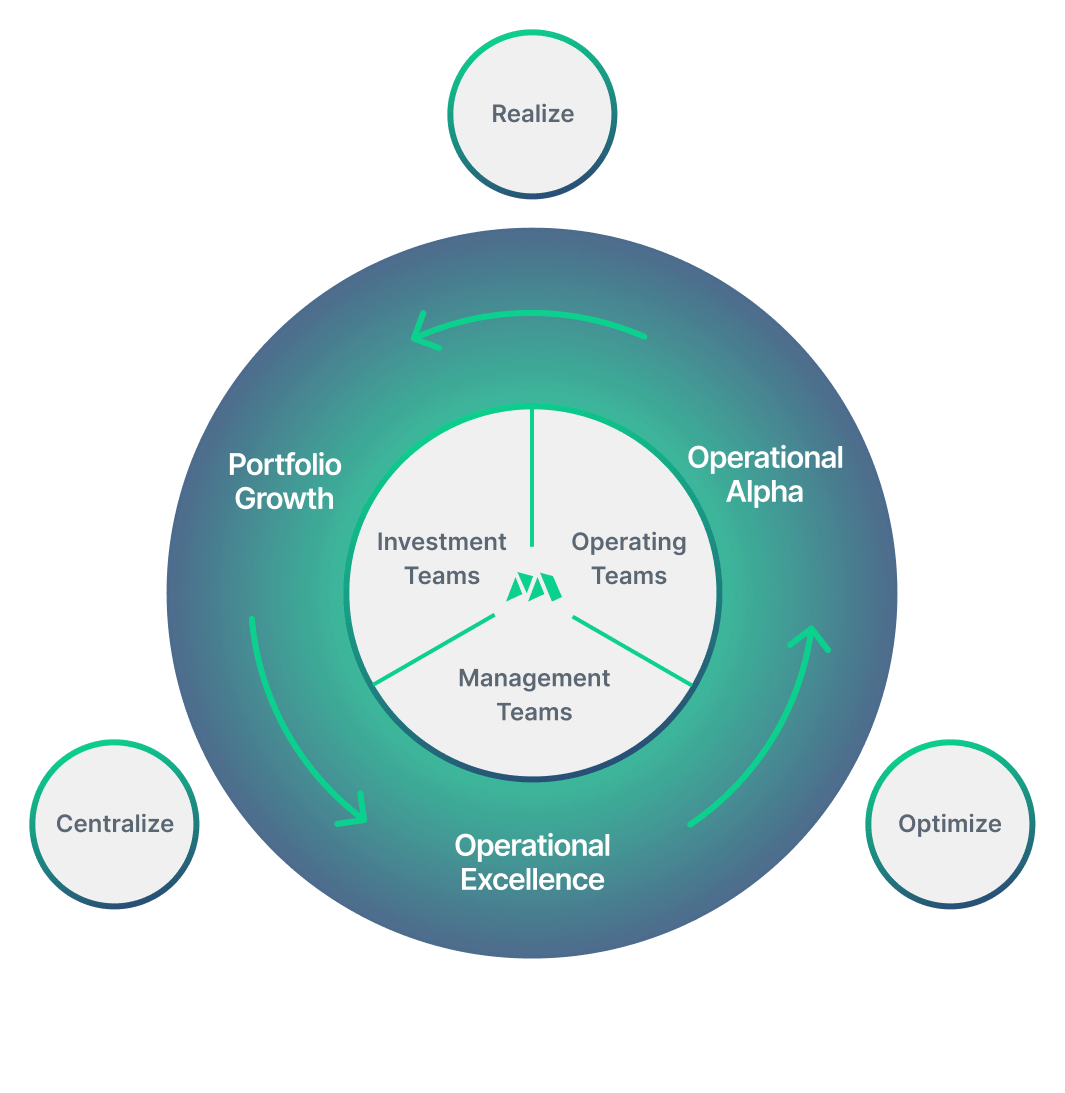

Drive operational alpha

Driving operational alpha requires aligned teams, clear vision, and flawless execution. Proving it requires data-driven narratives. Maestro delivers it all…

Execute on strategy, demonstrate value.

Empower Portfolio Company management teams, drive portfolio monitoring operations, and build confidence with current and future LPs with Maestro.

Transform your exit goals into an executable VCP, providing leadership teams with clarity on investor priorities, and purpose-built project management, integrations, and reporting tools to drive value. With real-time financial and operational data, and robust tracking, analytics, and reporting at the portfolio-company level and fund-wide, Maestro provides a 360° view of value creation, so you can steer success, demonstrate operational impact on financials, and deliver data-driven narratives that showcase growth.

”Argonaut approaches each of its investments as a partnership… and immediately recognized Maestro’s strengths in helping our portfolio partners grow their companies top and bottom lines.”

Vice President, Argonaut Private Equity

“Maestro is the primary tool that powers our integrated approach to value creation.”

Head of Marketing, PFB Custom Homes Group

Maestro drives operational alpha through…

Strategic planning

Align Teams | Get deal teams, operating teams, and management teams on the same page and in the same workflow system.

- Align the investment thesis with operational strategy.

- Create a single source of operational and financial truth.

- Set the 100-day plan in motion on day one.

- Establish frameworks, goals, and accountabilities.

- Ensure visibility and clarity for all stakeholders.

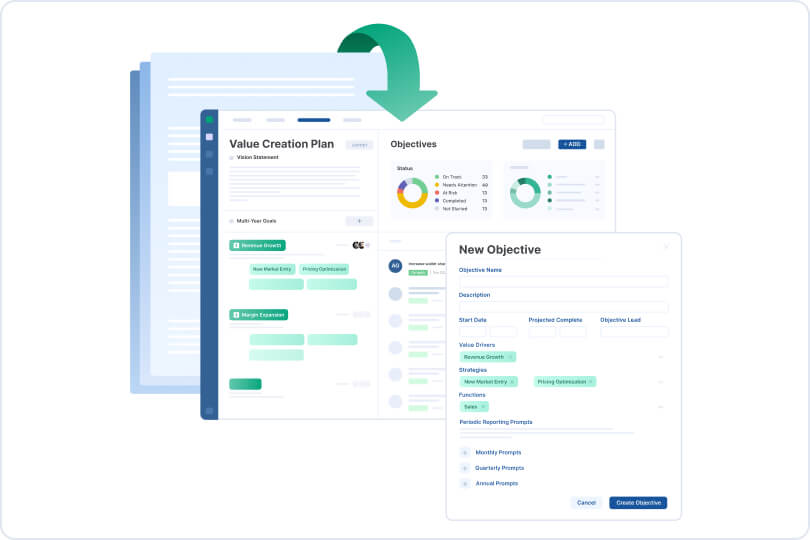

Strategy execution & governance

Deploy Strategy & Track Progress | leverage frameworks that support operational excellence and integrate real-time financial and operational data to surface cross-portfolio insights.

- Create projects, budgets, targets, and timelines.

- Measure progress with real-time financial and operational data.

- Track resource allocation and impact.

- Simplify the flow of information with easy workflows and assessments.

- Monitor and analyze ESG metrics across the portfolio.

- Automate reporting for management and board teams.

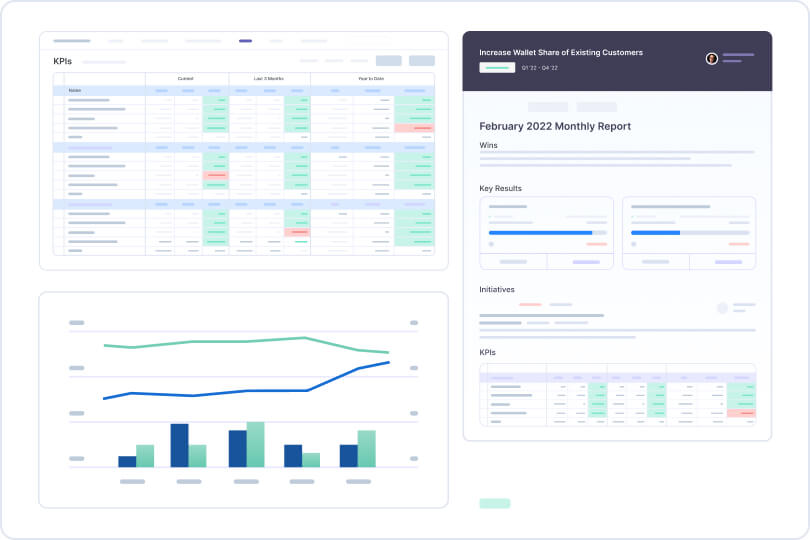

Value creation impact & reporting

Report on Results and Analyze Impact | identify the true drivers of growth and generate compelling value creation narratives for the diverse needs of operating partners, executive teams, boards, and LPs.

- Automate reporting for multiple audiences, meeting types & cadences.

- Integrate real-time financial and operational data.

- Build granular or high-level reports based on stakeholder requirements & meeting objectives.

- Quantify the impact of your value creation efforts.

See the difference

Plan & Align | Strategy

Inconsistent value creation planning and absence of true alignment and collaboration between sponsor and management teams

Maestro

Enhanced alignment and clarity among all teams around strategy, tactics, ownership, and success measures

Execute & Track | Value

Lack of ownership and understanding of desired outcomes among team members with limited ability to gauge status of projects

Maestro

Track progress of strategic initiatives seamlessly, leading to increased accountability and flawless execution of the value creation plan

Measure & Report | Efficiency

Data manually inputted into Excel spreadsheets, reports and documents shared via email, and presentations recreated for each meeting

Maestro

Automated data flows powers a single source of truth on KPIs, saving countless hours spent data wrangling and developing unique content

Repeat & Scale | Success

Lack of transparency and documentation around successful strategies and tactics, leading to minimal sharing of best practices

Maestro

Value creation success stories are captured in a structured manner, enabling repeatability across the portfolio

Hear from our clients

Argonaut approaches each of its investments as a partnership with the seller, and immediately recognized Maestro’s strengths in helping its portfolio partners grow their companies’ top and bottom lines. Within weeks of launch, the Argonaut operations team had Maestro up and running, using it to craft detailed value creation journeys and to track KPIs tied to investment objectives.

Brian GreenVice President, Argonaut Private Equity

Maestro is the primary tool that powers our integrated approach to value creation. Maestro allows me to have full visibility into plan objectives and helps me work in conjunction with other leaders at our company without siloes.

Melissa SopwithHead of Marketing, PFB Custom Homes Groups

For me, meetings are starting to be very easy and very productive. I just open Maestro, share my screen, and company leaders and stakeholders can have access as we navigate. I don’t need to reproduce other stuff which is very helpful.

Fernanda RavazzoloChief Strategy Officer, INW

We have a highly transformative agenda at our Portfolio Companies and Maestro has become the transformation source of truth across all levels of the organization, right up to board and deal teams.

Edward HennahVP Portfolio Operations, Motive PartnersFurther reading

Why Deal Teams Need a Tech-Enabled Approach to Alpha

Bridging Strategy and Execution in Transformation Projects

Maestro Integrations for CRM, Project Management and Communications

Schedule a product demo

Serving the world’s premier private equity firms and their portfolio companies, with offices in New York City and Boston.

Where to Find Us:

New York City

One Vanderbilt Ave, 24th FloorNew York, NY 10017

Boston

111 Huntington St, 6th Floor,Boston, MA 02199

Eager to learn more?

Download our brochure to learn more about how you can accelerate value creation at your firm.