Embedded BI

for deeper insights

Capture, visualize and leverage the insights that fuel value creation success with Maestro’s Embedded Business Intelligence.

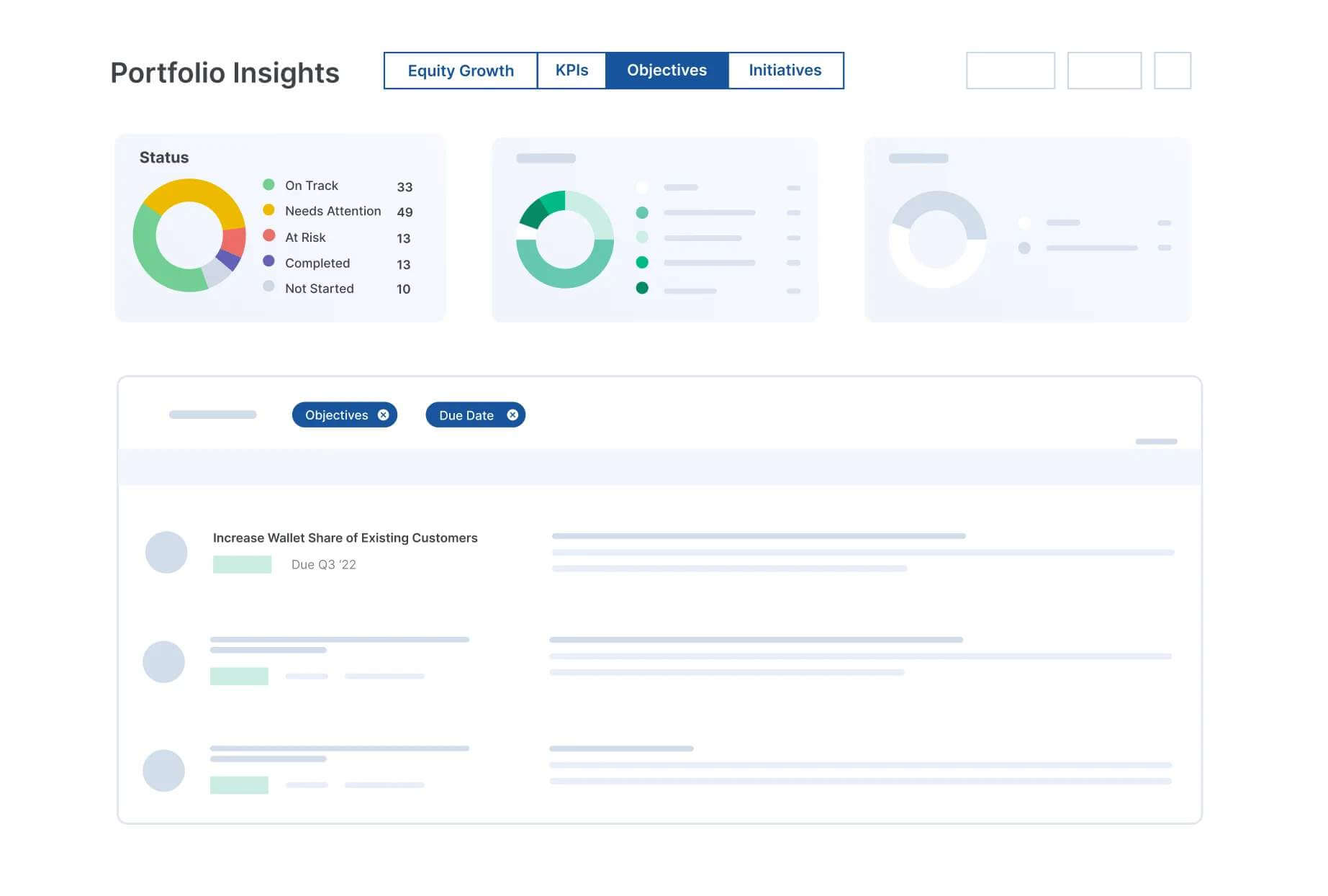

Unmatched visibility into the progress and impact of priorities & metrics

Gain data-driven insights into key growth levers that impact revenue, EBITDA or other financial metrics, and craft, analyze, and disseminate visualizations and reports of cross-portfolio metrics effortlessly.

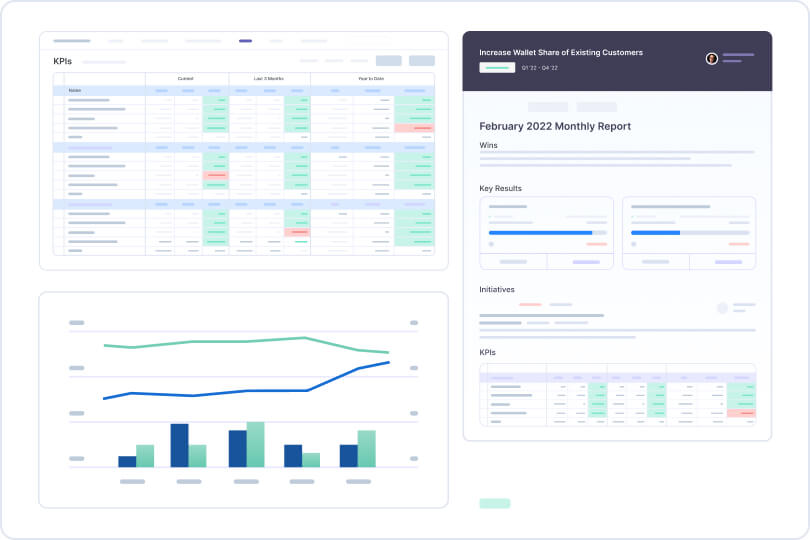

Cross-portfolio analytics in real-time

Maestro’s Embedded BI functionality lets teams unify and visualize qualitative and quantitative data for a 360-degree view of performance. Automate the collection and curation of any number of datasets to create standardized templates, dashboards, custom reports, and visualizations for individual companies and across the portfolio.

Key Features I Maestro Embedded Business Intelligence

Unified Data

Any data housed within Maestro can be combined with external data sources to build reports that track impact, gauge progress, understand attribution, solve problems, and reveal the up-to-the-moment state of the value creation journey.

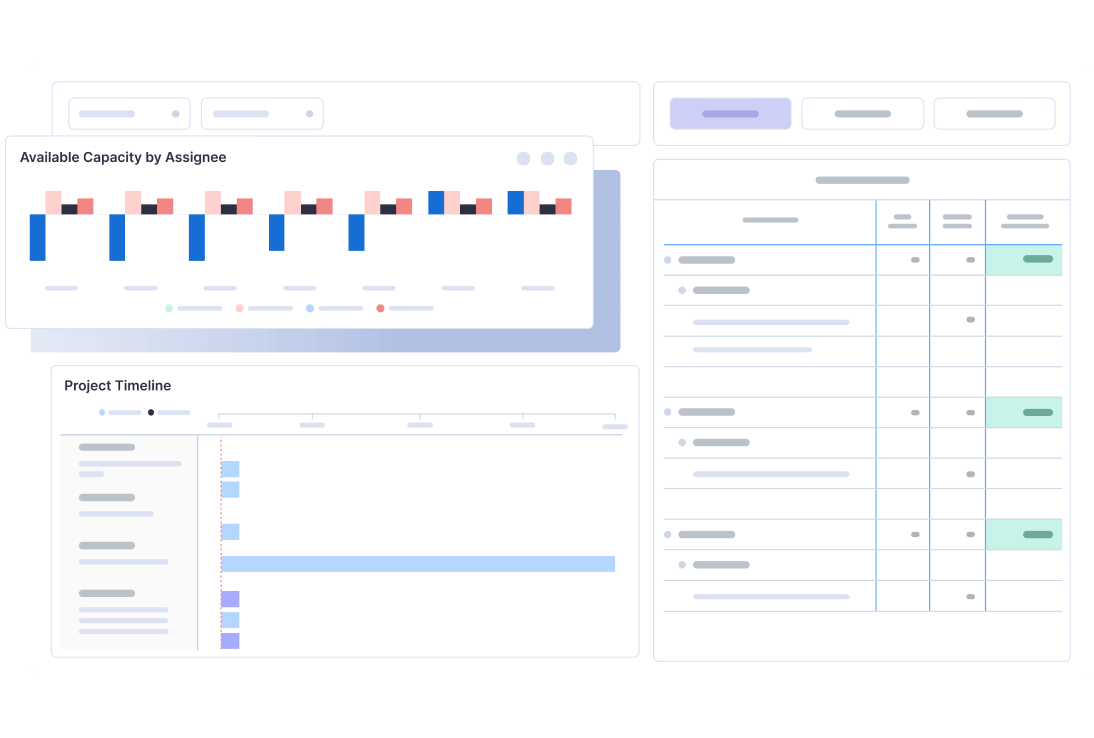

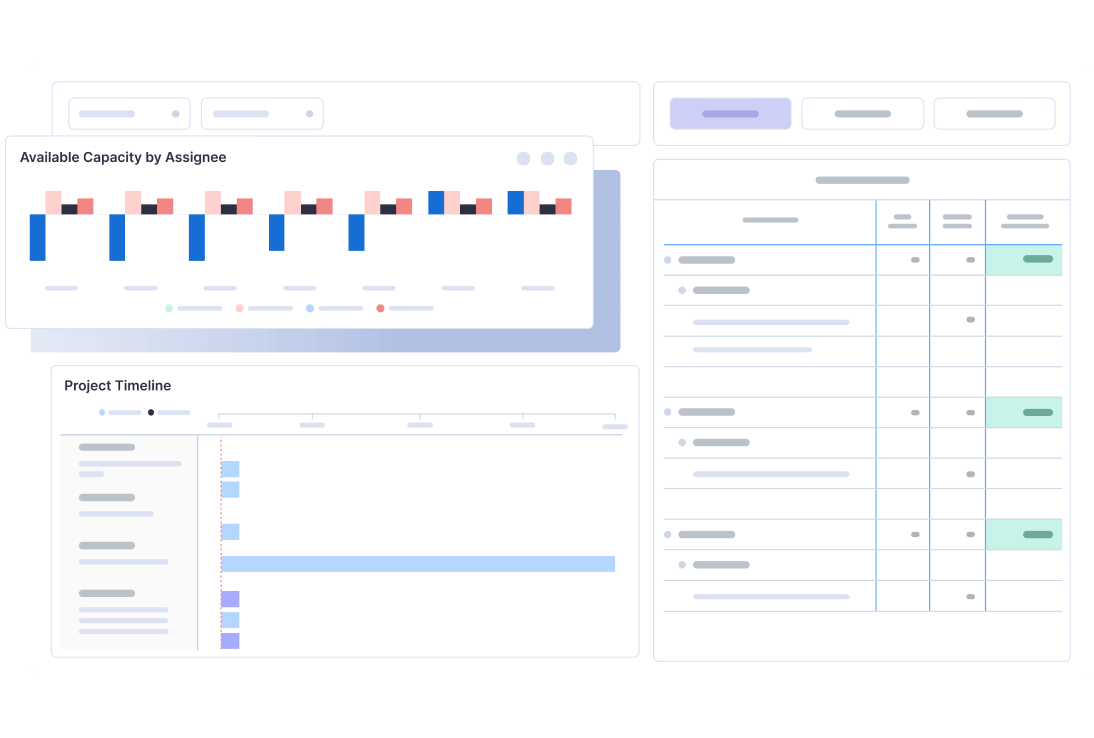

Workflow and Project Management

Blend BI and project management functionality via project analysis and customized reporting; unify and visualize timelines with customizable charting and flexible reporting combining any number of dependencies and datasets.

Fully Customizable

With configurable best-practice reports and statistics available out of the box, Maestro’s team of experienced data analysts can also provide customized data modeling services, combining datasets to generate reports with any level of desired detail and granularity.

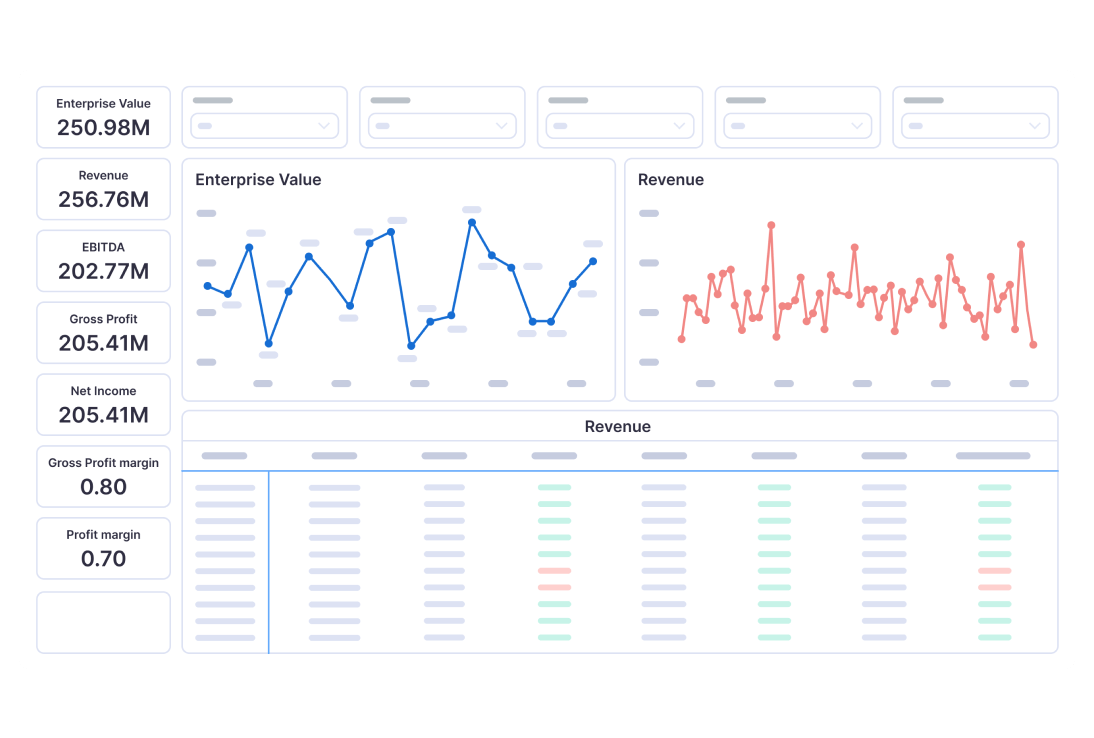

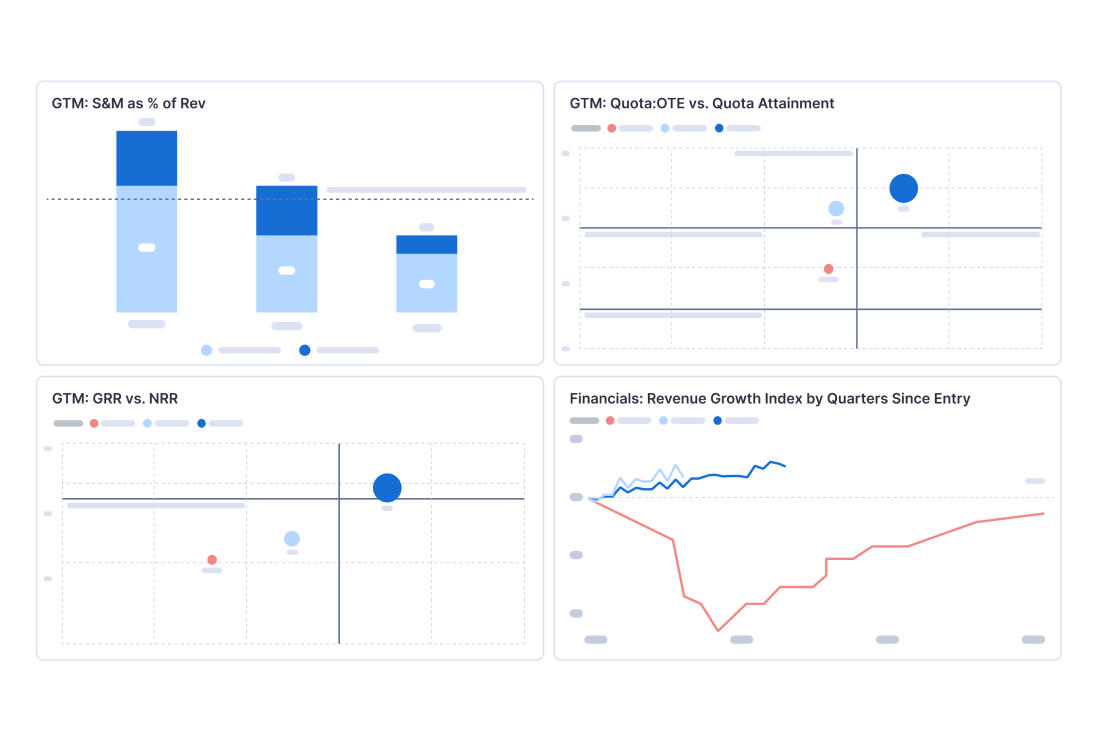

Real-time BI Dashboards & Snapshots

Configure BI dashboards across datasets to understand which strategies are propelling portfolio growth. Aggregate real-time financial and operating data to analyze impact and build personalized views and snapshots to assess progress, trends and risks in real-time.

Cross Functional Insights

All those involved in executing the value creation plan can now visualize and derive value from the data that matters most to them, when it matters – configure insights across operating Partners, deal teams, functional specialists, and Portfolio Company management teams.

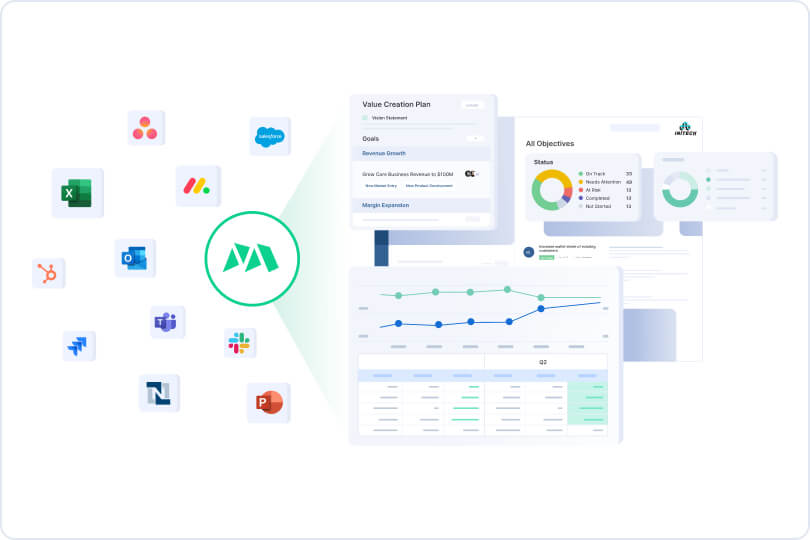

Best-in-Class Integrations

Ingest, aggregate, and organize all data assets for deeper insights and reporting on value creation process and impact. Maestro integrates with all the ERP, CRM and Data Warehouse platforms used by private equity firms and portfolio companies.

Latest from the blog

How Embedded BI & Reporting Unlocks the Full Potential of Private Equity Data

The insight you need, when you need it…

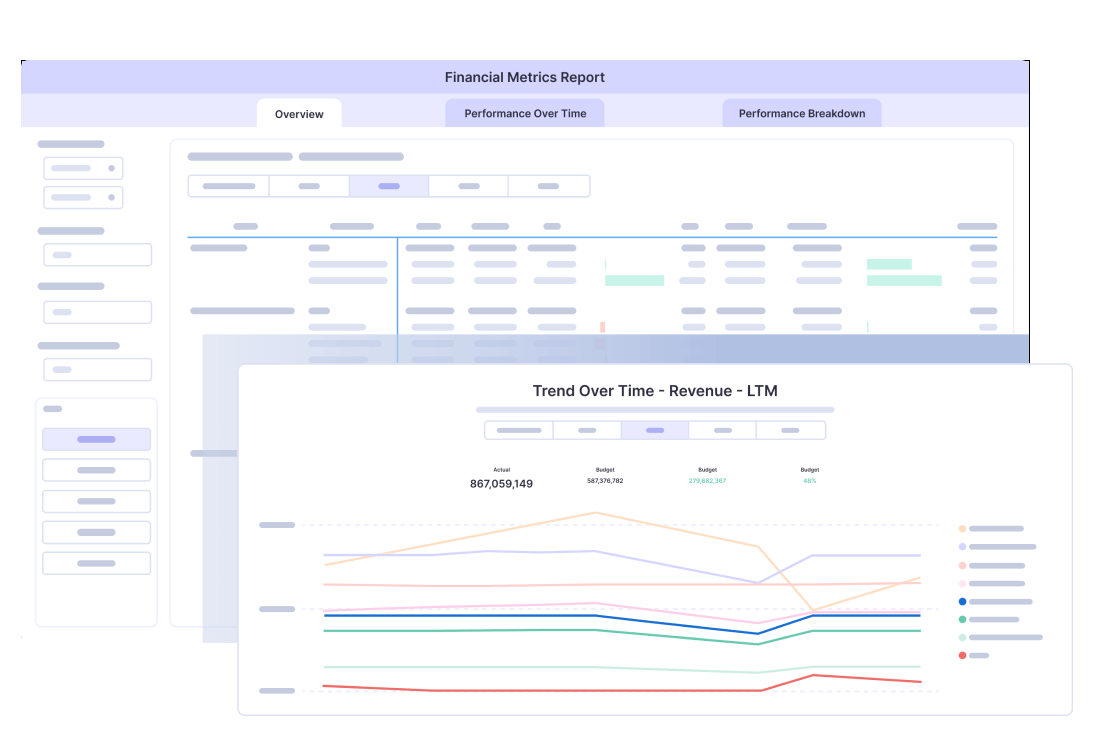

Track EBITDA impact

Generate reports that demonstrate the impact of specific objectives on EBITDA.

- Identify the activities moving the needle.

- Reveal gaps within a company’s strategic plan that need addressing.

- Identify and compare how projects at individual portfolio companies are driving growth outcomes.

Optimize resource allocation

Analyze and assess the allocation of resources, identify where adjustments are needed.

- Ensure specialists are assigned to projects with the greatest impact.

- Quickly identify where changes are needed to meet capacity demands and ensure time is allocated appropriately across initiatives.

- Pinpoint where resource constraints are impacting strategy and identify opportunities to deploy third party consultants and service providers for most value.

Visibility into financial health

Access real-time snapshots of a portfolio company’s finances for substantive interactions between deal teams, finance teams, and others within the office of the CFO.

- Generate detailed analytics reports showcasing top-line growth, availability and usage of cash, liquidity metrics, the status of budgets and forecasts, monthly or yearly comparisons, and a range of additional roll-up calculations.

- Produce a complete and up-to-date picture of each portfolio company’s overall financial health.

Endless data-driven possibilities

Analyze your data your way. Conduct quantifiable and objective portfolio-wide assessments and reports that showcase connections and correlations between performance and the bottom line. The opportunities are endless…

Analyze your data, your way

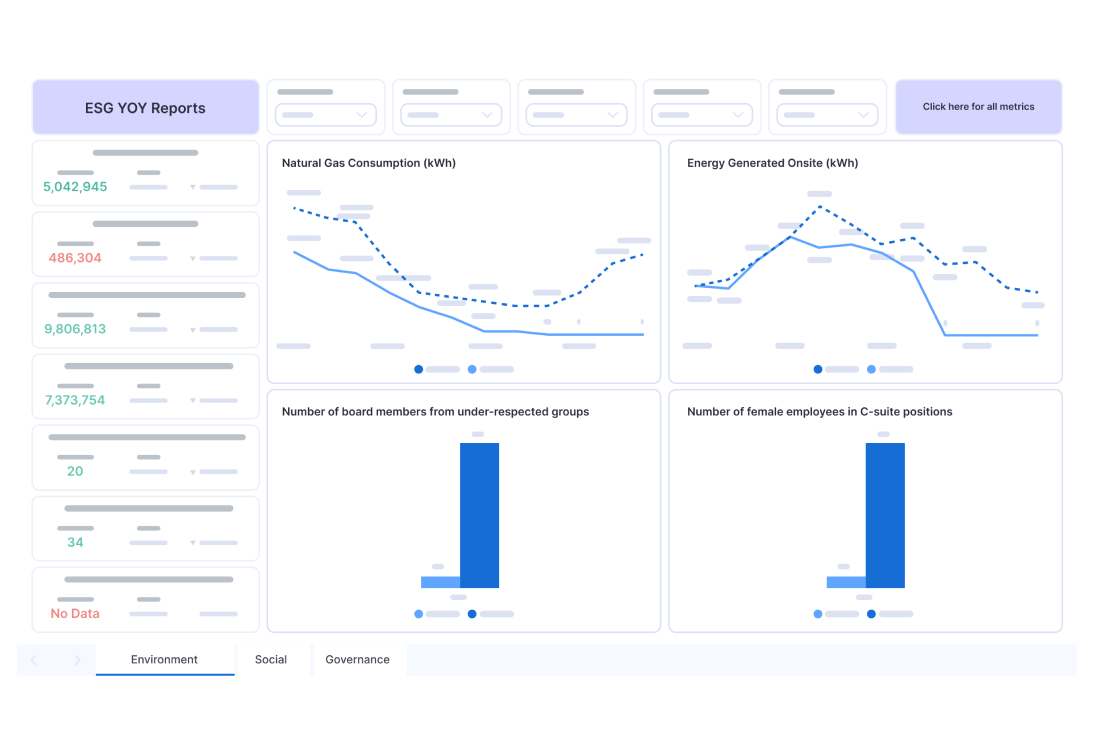

ESG insights

Capture ESG insights, visualize the results of PortCo surveys and capture broader metrics and ESG maturity highlights from across the portfolio.

Talent Assessments

Analyze talent assessments with portfolio-wide reports that overlay KPI metrics, benchmarks, compensation levels and performance relative to growth and valuation.

M&A synergies

Track M&A synergy performance with real-time comparisons of target vs. actual data over customizable time periods and compare synergy outcomes tailored to your business goals.

Maestro BI: Finally, Data Driven Insights Built for Value Creation

The ability to harness data-driven insights is critical across the PE Investment lifecycle, but business intelligence tools focused on value creation have been lacking. As Operational Alpha becomes a leading Private Equity growth lever, it’s no longer sufficient for firms to rely on manual processes, or limited visibility to measure, analyze, and optimize value creation initiatives. Maestro’s Embedded Business Intelligence and Reporting changes that…

Further Reading

Best in Class Integrations

A deeper dive into Maestro Integrations

Embedded BI & Reporting

Unlocking the Power of PE Data for Value Creation

Our Approach

Why the world’s top PE firms chose to work with Maestro

Schedule a demo

Serving the world’s premier private equity firms and their portfolio companies, with offices in New York City and Boston.

Where to find us

New York City

One Vanderbilt Ave, 24th Floor

New York, NY 10017

Boston

111 Huntington St, 6th Floor,Boston, MA 02199