Establish efficient operations

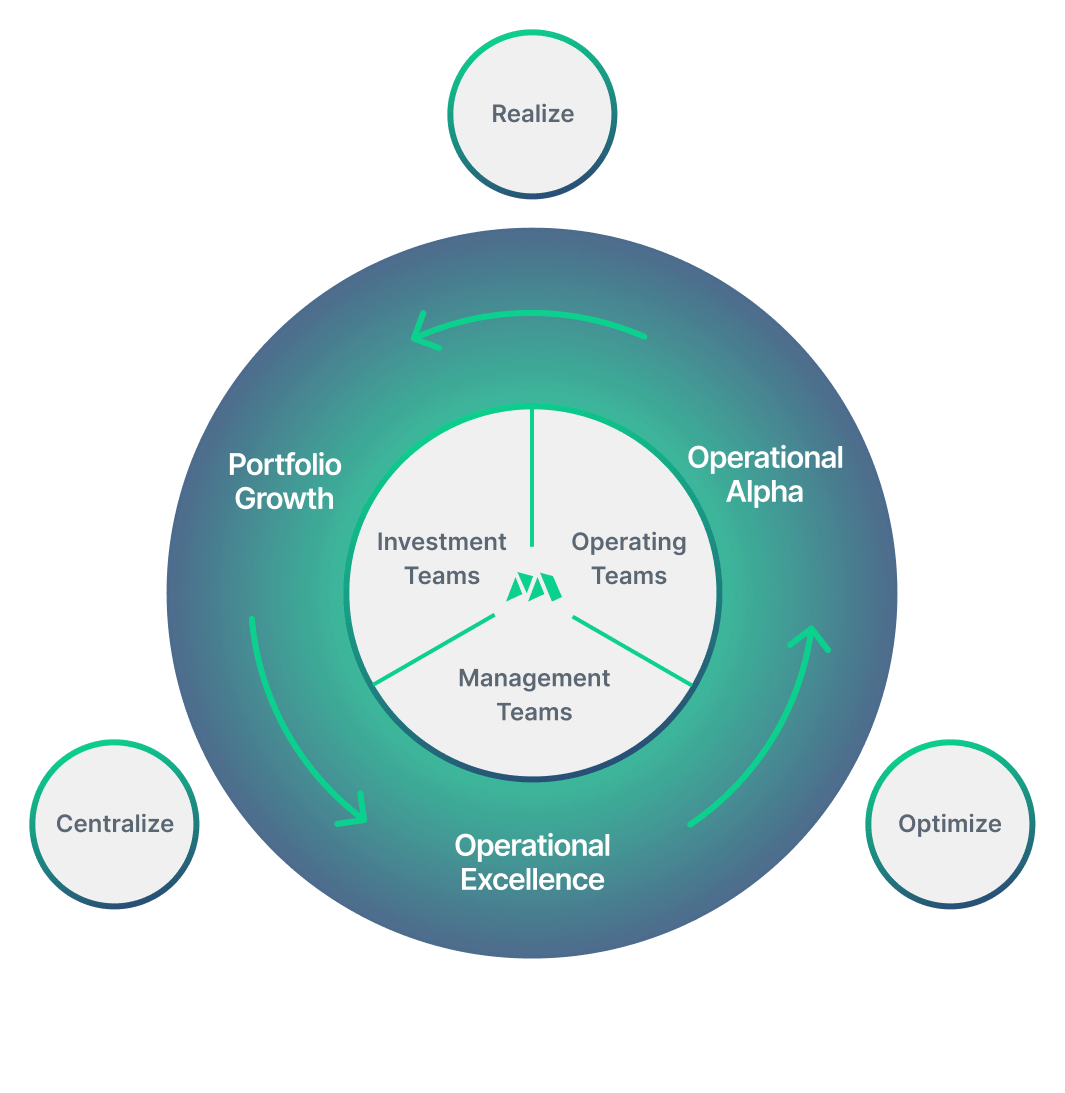

Establish operational best-practice, track value creation as the portfolio grows, and showcase your impact to existing and prospective investors.

A modern, tech-enabled operating model from day one.

In today’s competitive Private Equity environment, emerging managers must immediately begin building a track record of success.

Maestro is the PE platform that enables new funds to begin operating and investing with a technology-powered approach from day one. With a single centralized system and structured approach to operations, emerging managers distinguish themselves with LP investors, better compete for deals, and quickly begin driving value across their nascent portfolios.

“As we continue to deploy Fund 1, Maestro has become essential in helping our team memorialize our VCPs and KPIs to monitor progress across our portfolio from a holistic perspective. The Maestro team has collaborated closely with us to develop a scalable approach that drives efficiencies and strengthens our partnerships with portfolio companies.”

Maestro establishes day one operational efficiency through…

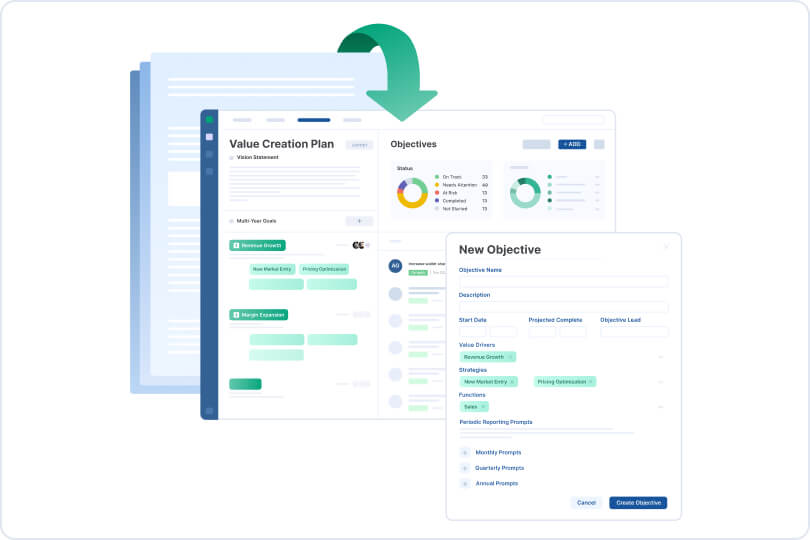

Strategic planning

Plan & Align | Define your strategy, build your plan, achieve alignment

Drive alignment and collaboration among deal teams, operating partners, and portfolio management to ensure transparency and understanding of the investment thesis from day one. Establish accountability around ownership of activities and tactics.

Strategic execution & governance

Execute & Track | Activate your plan, monitor real-time progress

Deploy the fundamentals of your value creation plan with clarity and purpose. Collaborate fluidly with management teams to implement tactics and approaches while providing visibility and transparency for deal teams and LPs as strategies and activities are executed.

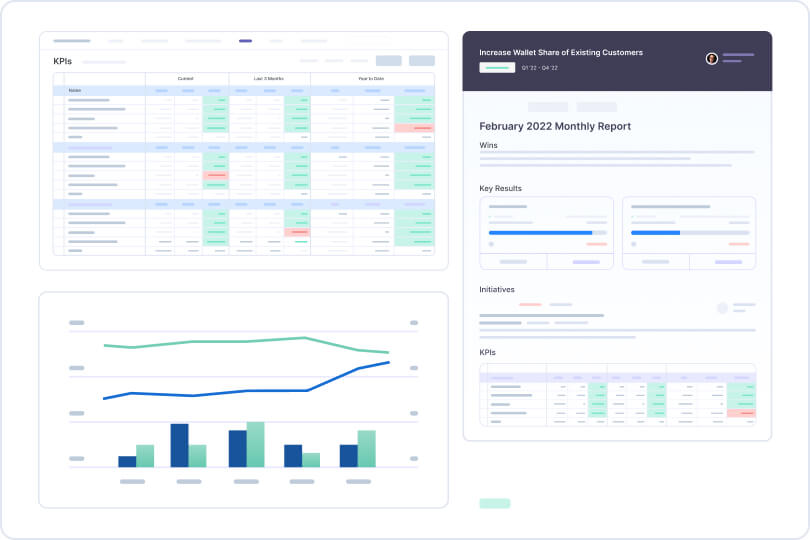

Value creation impact & reporting

Measure & Report | Gauge your impact, showcase outcomes to stakeholders.

See progress against the value creation plan in real-time. Capture and consolidate key measurement data derived from operating and management team activities. Generate streamlined, templated progress reports for deal teams, investors, and stakeholders.

Best-practice frameworks built-in

Without the burden of legacy systems, data silos or workflows to disrupt, emerging PE fund managers are in a unique position to build-out industry-leading value creation processes from day one.

Maestro acts as a strategic partner for emerging managers to establish

a consistent VCP framework and KPIs across the portfolio. Leveraging years of experience and market know-how, the Maestro team help realize your differentiated approach to value creation, aligning with the specific needs of your firm to deliver operational excellence for sustained growth, while keeping resources protected.

Powering more than

Private equity sponsors

Portfolio companies

Value creation initiatives

See the difference

Plan & Align | Strategy

Inconsistent value creation planning and absence of true alignment and collaboration between sponsor and management teams

Maestro

Enhanced alignment and clarity among all teams around strategy, tactics, ownership, and success measures

Execute & Track | Value

Lack of ownership and understanding of desired outcomes among team members with limited ability to gauge status of projects

Maestro

Track progress of strategic initiatives seamlessly, leading to increased accountability and flawless execution of the value creation plan

Measure & Report | Efficiency

Data manually inputted into Excel spreadsheets, reports and documents shared via email, and presentations recreated for each meeting

Maestro

Automated data flows powers a single source of truth on KPIs, saving countless hours spent data wrangling and developing unique content

Repeat & Scale | Success

Lack of transparency and documentation around successful strategies and tactics, leading to minimal sharing of best practices

Maestro

Value creation success stories are captured in a structured manner, enabling repeatability across the portfolio

Schedule a product demo

Serving the world’s premier private equity firms and their portfolio companies, with offices in New York City and Boston.

Where to Find Us:

New York City

One Vanderbilt Ave, 24th FloorNew York, NY 10017

Boston

111 Huntington St, 6th Floor,Boston, MA 02199

Eager to learn more?

Download our brochure to learn more about how you can accelerate value creation at your firm.

![How Growth Factors Unlocked Portfolio Visibility Across Bregal Sagemount with Maestro and iLEVEL [Client Story]](https://www.go-maestro.com/wp-content/uploads/2024/10/1679828301042.jpeg)