Accelerate company growth

Streamline the core operations that support your company’s growth and deepen the working relationship with your investor.

The strategy execution platform designed for PE-backed management teams

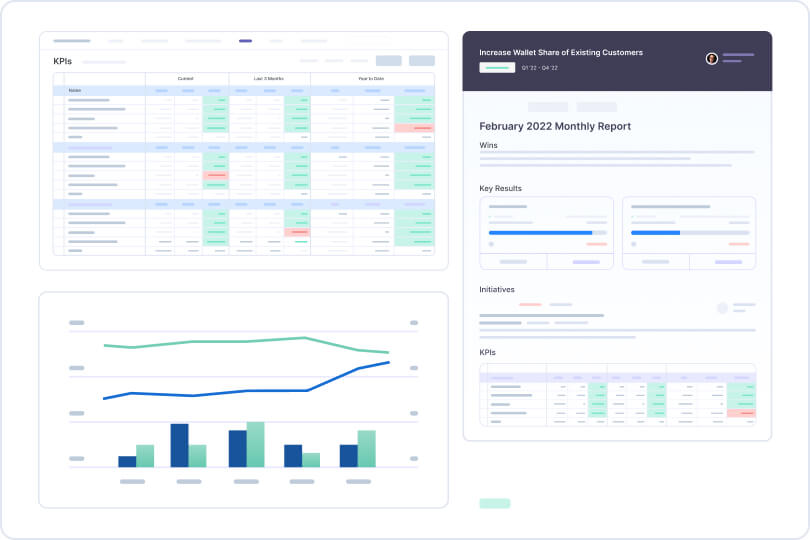

Maestro brings your management team and your investor together on a single platform to align on strategy, deliver on execution, and accelerate value. For company executives and across business functions, Maestro streamlines and simplifies workflows, tracking metrics and reporting processes so you can focus on what matters most – driving growth.

Drive initiatives, ease reporting.

Eliminate data silos, arduous reporting processes and unproductive meetings.

Get clear visibility into the progress and performance of your firm’s most critical priorities and metrics, and get the relevant information to stakeholders, without draining executive time. When it’s time to report to your board, the financial and operational data you need is ready in real-time, waiting to export and share.

“As an OKR tracking tool, Maestro is fantastic.You can see the initiatives, key results, and KPIs all on one page.”

Head of Business Management & Transformation at Linnworks, a Marlin Equity Partners portfolio company.

“Meetings are [now] very easy and very productive. I just open Maestro, share my screen, and company leaders and stakeholders can have access as we navigate.”

Chief Strategy Officer for INW, a Mubadala portfolio company.

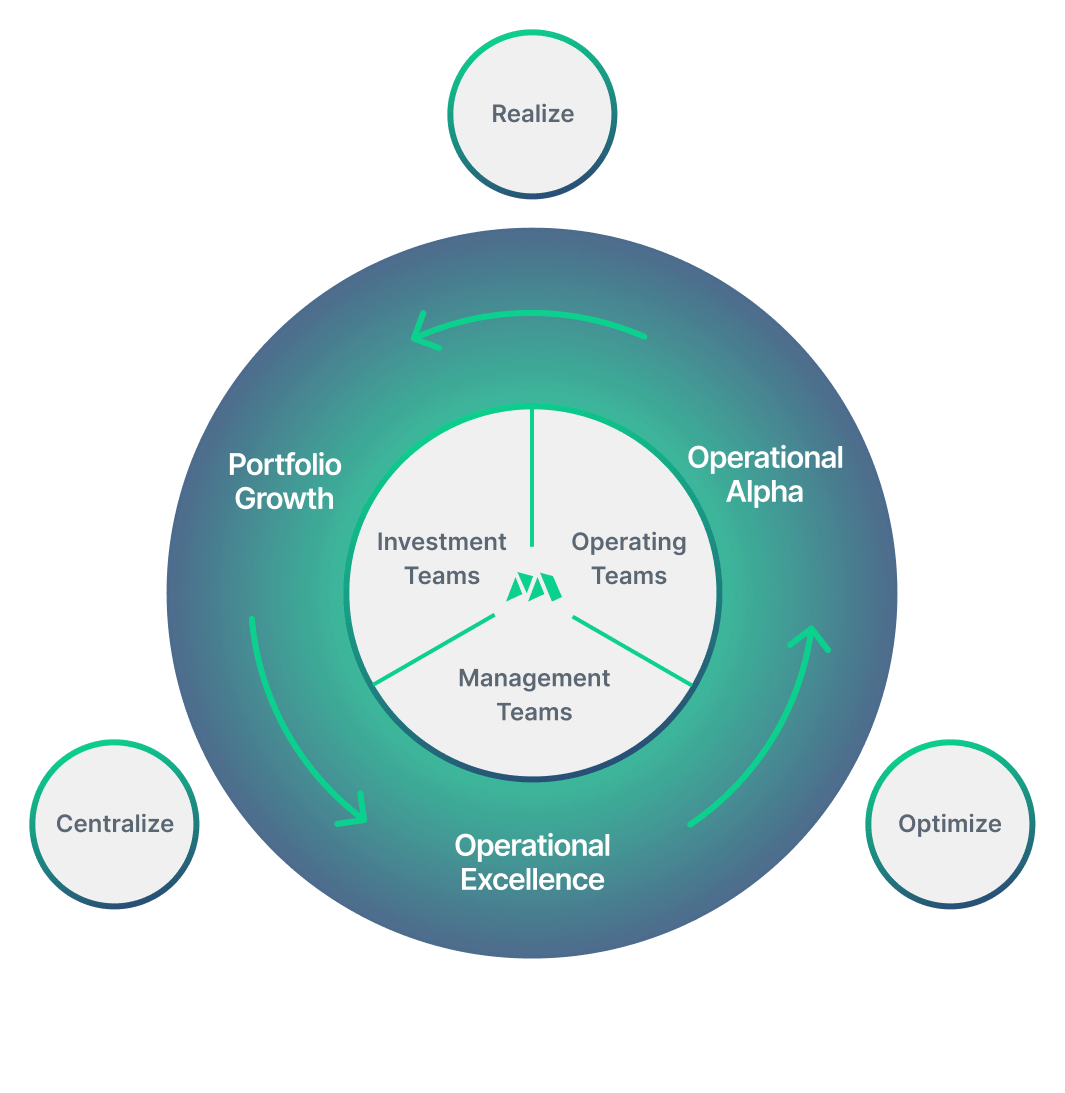

Maestro accelerates growth through…

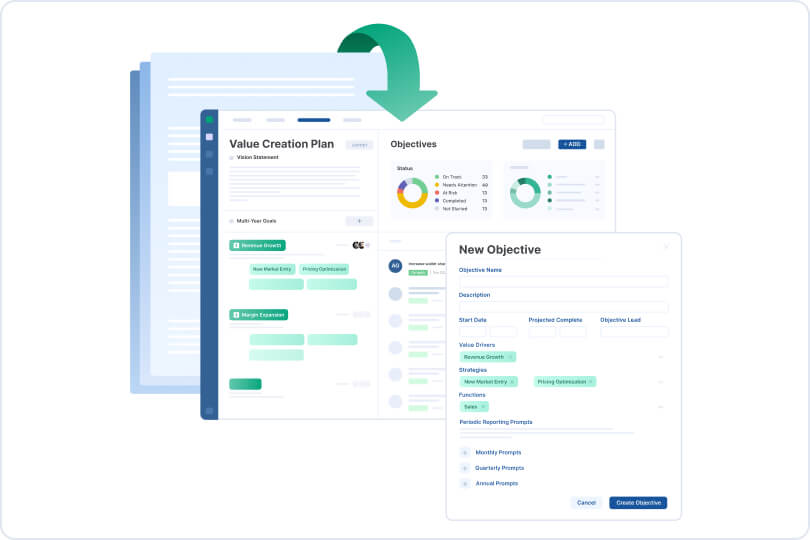

Strategic planning

Align and Plan | Align with your investor on a platform that captures a detailed, digitized version of the strategic plan for growth.

Achieve clarity on investor priorities and expectations and accelerate alignment on value creation initiatives and exit goals.

Strategy execution & tracking

Execute & Monitor | Assign project ownership and KPIs across functions, track project status, manage priorities, and power internal meetings.

Provide real-time visibility into progress against goals, simplify and automate reporting for weekly, monthly and quarterly meetings.

Governance & reporting

Report & Measure | Simplify governance and reporting for executive staff and functional teams. Report on the operating and financial metrics that matter and power monthly operating reviews, board meeting preparation and weekly management meetings.

Ease the transition.

Deepen the relationship.

Whether you’re practiced at working with private equity investors or new to the PE-backed operating model, Maestro eases the transition to private equity sponsorship for your company’s executive team and functional leadership.

The Maestro platform builds deeper trust and alignment between you and your investors from day one with a collaborative and transparent process that brings everyone on the same page.

Further reading

How Three PE-Backed Companies Use Maestro to Track, Progress, Establish Accountability & Achieve Results.

How Trust, Flexibility & Embracing New Approaches Can Help CEOs Adapt to PE Ownership

Maestro Integrations for CRM, Project Management and Communications

Powering more than

Private equity sponsors

Portfolio companies

Value creation initiatives

Schedule a product demo

Serving the world’s premier private equity firms and their portfolio companies, with offices in New York City and Boston.

Where to Find Us:

New York City

One Vanderbilt Ave, 24th FloorNew York, NY 10017

Boston

111 Huntington St, 6th Floor,Boston, MA 02199

Eager to learn more?

Download our brochure to learn more about how you can accelerate value creation at your firm

![How Growth Factors Unlocked Portfolio Visibility Across Bregal Sagemount with Maestro and iLEVEL [Client Story]](https://www.go-maestro.com/wp-content/uploads/2024/10/1679828301042.jpeg)