Bridging the Data Disconnect in Private Equity

With increased frequency, private equity firms are embracing and leveraging data to drive smarter investing decisions, execute value creation activities, and manage internal financial operations. Many have invested in some of the next-generation analytics platforms designed specifically to help GPs and partners operationalize value creation plans and capture, analyze, and make sense of the dizzying array of metrics and statistics. The sources and pools of data on which sponsors rely to make informed decisions and monitor growth across their respective portfolios continue to widen and deepen in complexity.

As many sponsors have modernized their operations and continue to integrate data into their day-to-day activities, a new challenge has emerged. In many cases, the disparate systems and solutions deployed to drive value creation activities and manage data flows, both internally and externally, are disconnected from one another. The validation of data passed through the organization is done manually and, therefore, prone to errors. Consequently, stakeholders are unable to efficiently access accurate data in a timely fashion amid an environment where reporting and regulatory obligations are heightened.

For sponsors, it’s not enough just to have a data strategy. A technology-driven process for managing data is a critical necessity, as well. Achieving this means building a centralized “process hub” where connectivity is established between all systems and teams, enabling a continuous flow of timely and validated data accessible to all.

These days, data simply cannot be siloed between the front, middle, and back offices, as perhaps they once were. All partners and stakeholders need access to the same validated and verified data, even if they may be using it for different purposes.

Case in point, those responsible for managing the finances of the firm and reporting to investors need access to portfolio performance data that typically resides in front office systems. In addition, portfolio team-engaged partners responsible for implementing value creation initiatives must have access to financial and operational data that sits in portfolio company systems. The same data measuring the status of an individual portfolio company’s value creation plan is also critical for financial reporting to LPs.

When teams are unable to access data or don’t have supreme confidence in its accuracy, time and resources are wasted chasing people down to collect and then verify the numbers. This is a critical time that could and should be allocated toward more substantive, mission-critical work.

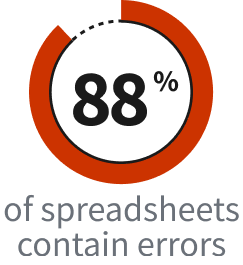

Additionally, when data is manually moved from one macro-filled Excel spreadsheet to another, the chance for errors increases. A recent analysis by IHS Markit found that nearly 88% of spreadsheets contain errors while half have material defects. These errors can lead to disastrous results ranging from poor investment decisions, missed opportunities to adjust the value creation plan, and costly and reputation-damaging mistakes in investor reports and regulatory filings. Some of the most prominent financial brands have suffered millions in losses resulting from spreadsheet errors.

For sponsors suffering from data disconnect, the motivation and urgency to enhance their management processes should be evident.

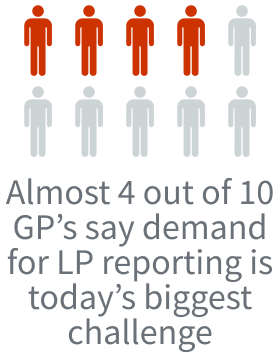

- First, increased investor scrutiny in today’s tumultuous economic climate means GPs better have accurate financials and full knowledge of the status of value creation initiatives at the ready. In a recent survey, 38% of GPs stated that demand for reporting to LPs is the largest challenge they face today in terms of managing their operations.

- Second, in the already highly regulated private equity industry, reporting requirements are always getting more detailed and nuanced. One can always expect new and more onerous regulations to come down the pike requiring deeper levels of data and more frequent filing obligations.

- Finally, the volume and granularity of data are expected to increase exponentially in the years to come across each phase of the investment lifecycle. From GP level accounting to portfolio level data, volumes are already at levels beyond what a human being could possibly handle. With recent studies suggesting that PE sponsors can expect a 150% increase in data sets and sources in the next year alone, the time is now to upgrade data management processes.

It won’t be too long before the only conceivable way sponsors can effectively use data to drive value, nimbly react to regulatory changes, and placate discerning investors is by deploying a specialized data management platform that can connect all systems, offices, and stakeholders in an automated way. There are already too many examples of in-house or white-label solutions failing to achieve these aims. Adopting an integrated approach across platforms and teams that can break down siloes and establish cohesion between the value-creating activities of the front office and operational elements of the back office must be a priority for all sponsors.

About ![]()

Developed for the private markets industry, Exchangelodge automates inefficient, error-prone manual data processes, and supplies actionable information ready for decision-making.

The software powers data workflows by integrating existing systems and cleansing all data for accuracy and completeness with its sophisticated business rules engine. By implementing Exchangelodge’s configurable platform, clients improve data conviction and execute on their business goals with scale and precision.

Leading GPs, LPs and service providers are adopting Exchangelodge technology to use their private markets data with confidence. With Exchangelodge, trusted private markets data emerges.

About ![]()

Maestro is the value creation platform designed exclusively for the Private Equity industry. Founded by Accordion, the PE-focused financial consulting and technology firm, and backed by S&P Global Market Intelligence, Maestro helps PE sponsors modernize their operations and maximize value creation in private equity–backed companies through enhanced portfolio management and increased collaboration with all stakeholders. The Maestro platform serves as an essential solution for the private equity industry – from diligence to exit.