Case Study: ESG Survey Module

For private equity firms eager to understand how their portfolio companies are faring against ESG goals, fielding intermittent questionnaires and manually inputting responses into spreadsheets is no longer sufficient or sustainable.

This was the challenge facing a mid-size European private equity sponsor with an expansive portfolio of investments across a range of diverse sectors. As the firm increasingly came to see ESG as both a material investment factor as well as a value creation opportunity, they realized they needed a better and more formalized approach to assessing, monitoring, and gauging ESG performance.

After conducting a comprehensive evaluation of available solutions, the firm selected Maestro’s ESG survey module, seeing it as the ideal tool needed to meet the firm’s expanding ESG measurement needs.

Before deploying Maestro, most of the firm’s ESG maturity assessments had been conducted in an ad-hoc fashion, either by partner volunteers or expensive outside consultants. There was little coordination or structure, nor was there a consistent approach to measuring ESG across the whole portfolio of more than 80 primary investments.

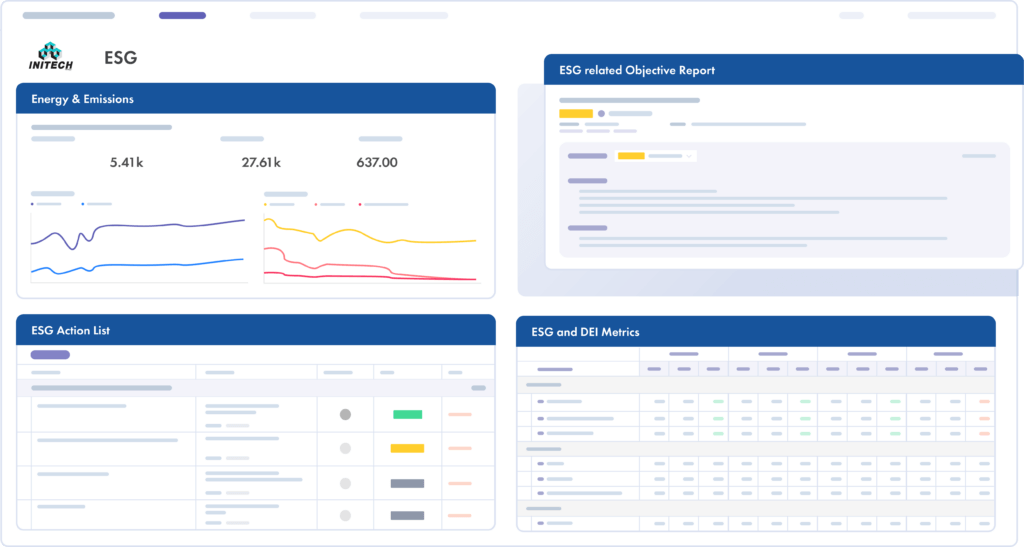

Now, using Maestro’s ESG survey module, the sponsor can create and field bespoke surveys for each one of their companies within an established cadence. Responses generated seamlessly inside the platform allow the firm to quickly understand overall ESG maturity, monitor progress on an ongoing basis, and identify outstanding risks and opportunities. Operating teams can benchmark performance, forecast a path for continued improvement, and compare one business to the next across sectors. ESG data collected by the surveys can be exported, visualized, and communicated to stakeholders to demonstrate impact. Progress and results of ESG-related initiatives can also be tied to broader value creation objectives, all within the Maestro environment.

The Maestro ESG survey module benefits the firm’s portfolio teams as well, as they can now easily respond to the ESG information and data requests from their investor with efficiency, in a cost-effective manner, and without having to divert attention from core business activities. Additionally, after completing a survey, portfolio teams see their score and how they compare against the rest of the portfolio almost in real-time, helping them earn a pat on the back or providing the proper motivation to make the necessary changes that drive improvements.

AS ESG continues to grow in importance as both a driver of investment decisions and lever of value creation, private equity firms using Maestro’s ESG survey module can have a tech-enabled and modernized solution for collecting, reviewing, managing, and monitoring ESG performance and acquiring a real-time understanding of ESG risk and opportunity across the portfolio.