Understanding Where it All Fits: The Role of the Value Creation Platform in the PE Tech Stack

Perhaps more by necessity than choice, Private Equity has finally embraced technology, albeit to varying degrees.

The continued growth of funds, both in size and numbers, combined with the competitive nature of the market has necessitated the use of modern technology among the front office teams, even within some of the more traditional sponsors. With ever-growing portfolios, using manual processes and spreadsheets to manage, track, and report on portfolio growth & value creation is simply no longer a viable option.

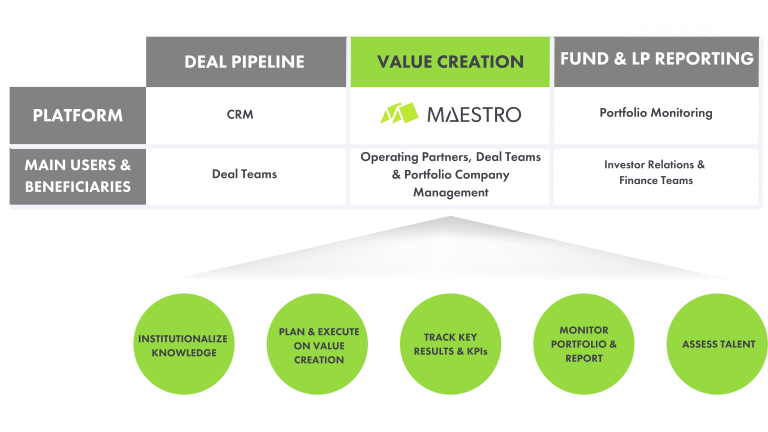

Just as PE Assets Under Management (AUM) and deal sizes have increased, so has the universe of technology solutions created for the front-office teams, each with its unique value proposition and focus on a different segment of the PE lifecycle. Sponsors late to the technology game or stuck in the starting gates may find it challenging to decipher between the various platforms and their offerings.

We’re here to help, and we’ll do so by taking a stroll down memory lane.

When technology began to infiltrate PE, the first level of innovation focused primarily on middle and back-office solutions such as Virtual Data Rooms, LP Portals, and Fund Administration. LP investors began to require greater transparency and more frequent reporting related to the health of their investments. Sponsors then turned to Portfolio Monitoring solutions to meet these demands and understand for themselves what was happening within the portfolio at the end of each reporting period.

Sponsors then came to realize the need for a more sophisticated and modern approach to managing the accelerating pace and increasing volume of deals. Enter deal sourcing and deal pipeline management platforms and the second wave of PE technology innovation, this time targeting the front-office teams. These platforms help teams identify the right deals to pursue, conduct due diligence in a more transparent way, and manage the workflow around deal pipeline management.

Today, we have arrived at the next evolution of PE technology that’s bringing together the entire front-office ecosystem of deal teams, operating partners, and portfolio company management teams.

Back in the day, investors could usually count on solid returns simply by buying and holding an asset. Financial engineering helped drive even greater returns. But with competition for deals driving entry multiples to new heights, those tactics no longer deliver expected returns in today’s PE.

As a result, the role of the operating partner has moved to the front and center. Along with deal teams, operating partners are attempting to take a hands-on, proactive approach to driving growth and creating value across the portfolio, and accelerating return on investment. Doing so efficiently and effectively requires the next level of PE technology innovation – the Value Creation platform.

They are now the third leg in the trifecta of fit-for-purpose PE platform solutions every sponsor should have – filling a critical unmet need in the investment lifecycle between existing deal pipeline and portfolio monitoring platforms.

Some PE SaaS providers, particularly in the CRM and Portfolio Monitoring space, have attempted to dip their toes into the value creation arena. There have also been forays by non-PE-specific solutions to address this need. Some PE sponsors have built their own workflows and solutions on top of their existing tech stack. Ultimately, most PE firms have realized that adopting a best-in-breed approach drives the optimal business outcomes for them.

Portfolio monitoring solutions are great for calculating valuations, and financial returns like the IRR of the portfolio. CRM and Deal Pipeline Management help sponsors manage ever-increasing deal flow and LP relationships. But neither drives growth and value of the portfolio proactively. That’s where the Value Creation platform is distinctive and unique, solely focused on helping sponsors elevate financial and operational performance across the portfolio and ultimately delivering maximum financial results for all stakeholders.